Growing Leaders for Tomorrow

Our students learn what it means to be community leaders by exploring the history and values of America. Together, they grow in respect, responsibility, and pride for their country and community

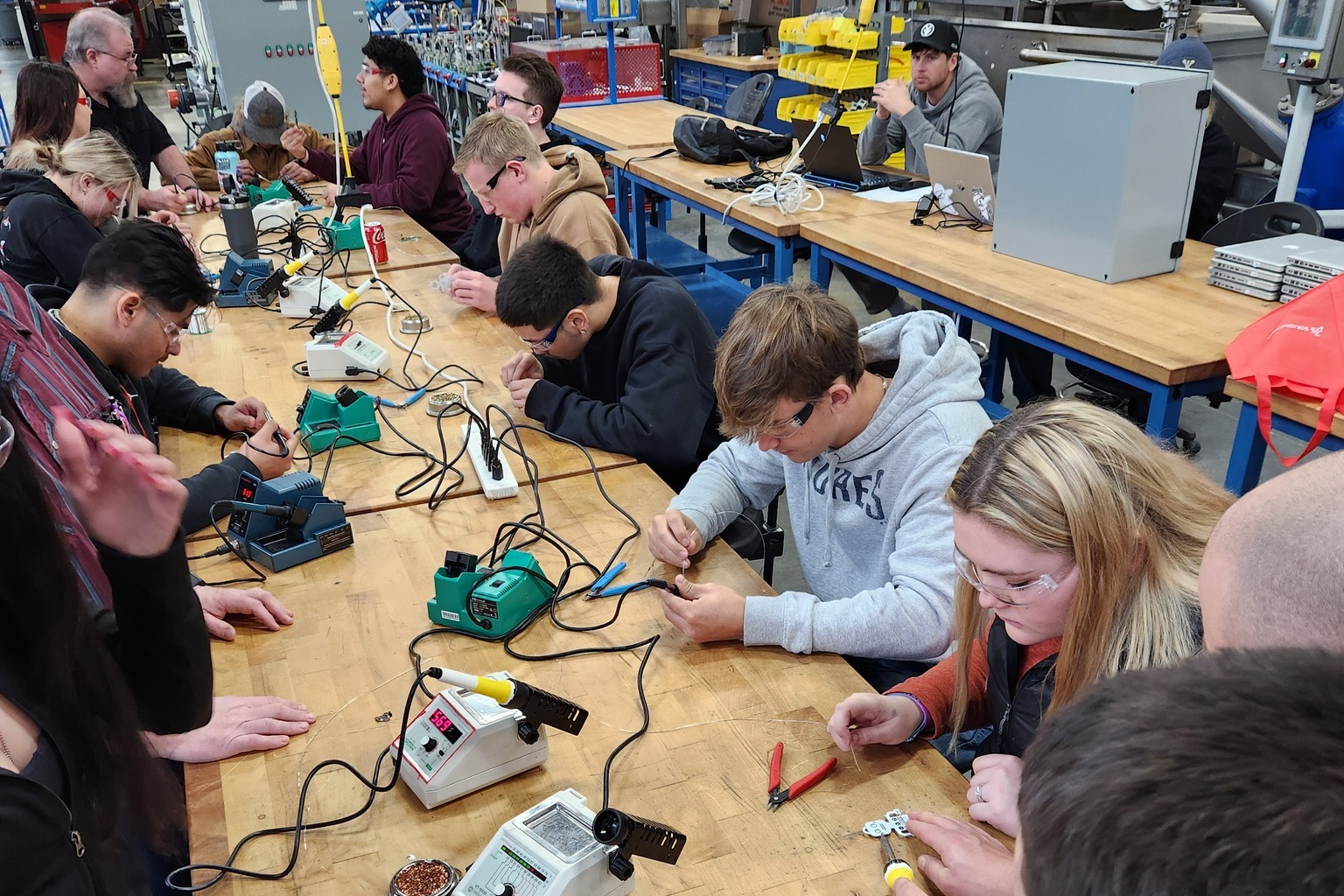

Career Technical Education

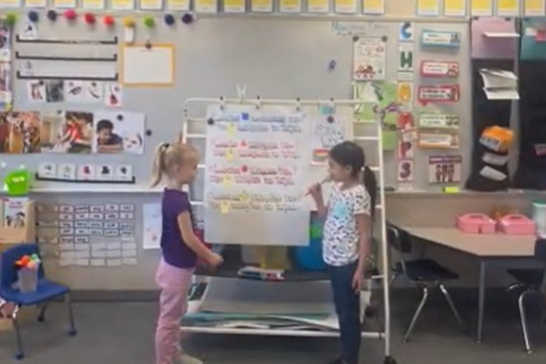

Dual Immersion

Performing Arts

Athletics

Visual Arts

Agriculture

Technology

Mental Health Support

Gifted & Talented

Special Education

Alternative Education